Buying a home is a big step in your financial journey. It can feel overwhelming, but with the right help, you can get the financing you need. This guide will help you understand the home financing process. We’ll cover everything from the first steps to budgeting and mortgage options.

Key Takeaways

- Gain a comprehensive understanding of the home financing process to make informed decisions.

- Assess your financial readiness and explore different home loan options, including conventional and government-insured loans.

- Determine your mortgage budget and learn strategies to improve your credit score for better loan terms.

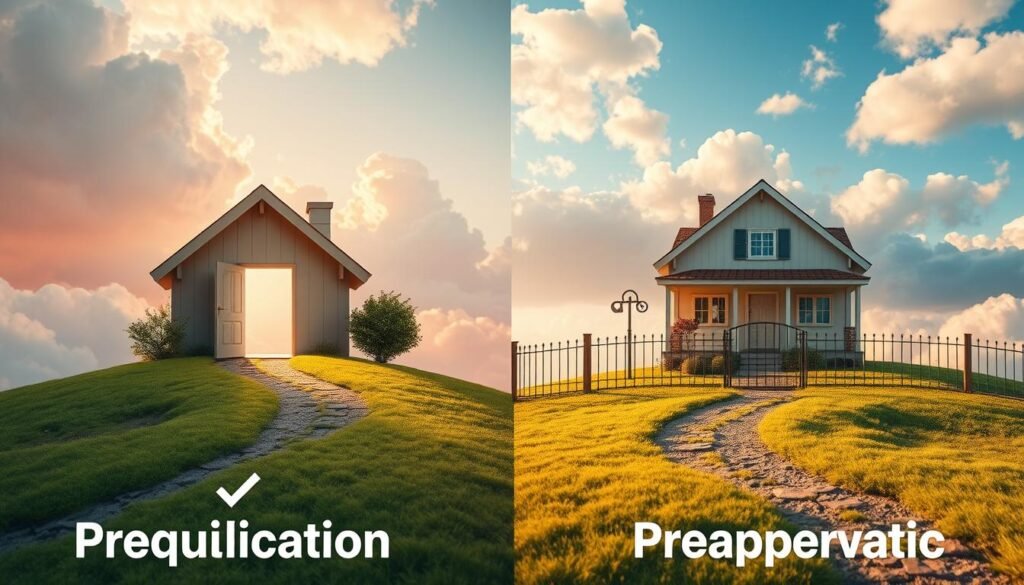

- Understand the importance of preapproval and the differences between prequalification and preapproval.

- Discover down payment strategies and learn about closing costs and other fees associated with home financing.

Understanding the Home Buying Process

Starting your journey to buy a home is both thrilling and challenging. Before you look into financing, it’s key to know the home buying steps. This part will walk you through the main steps, from checking your finances to looking at the local housing market.

Assessing Your Financial Readiness

The first thing to do is check your financial health. Look at your income, debts, and savings to see if you can afford a mortgage. Begin by reviewing your monthly income and expenses, including any loans or credit card debt. Find ways to save money for a down payment and monthly mortgage payments.

Also, check your credit score and report. It greatly affects your financing options and interest rates. Work on improving your credit score by paying off debts and fixing any credit report errors.

Researching the Housing Market

After checking your finances, it’s time to explore the local housing market. Understand home prices, trends, and available properties in your area. Look at online listings, visit open houses, and talk to local agents to learn more about the home buying process and what you need financially.

- Research median home prices in your target area

- Identify market trends, such as the average time homes spend on the market

- Explore the availability of properties that fit your budget and preferences

By knowing the housing market and your financial situation, you’ll be ready to buy your dream home. This knowledge helps you make a smart choice when it’s time to buy.

Home Financing Fundamentals

Understanding home financing can seem tough, but knowing the basics is crucial. It’s the first step to owning a home. Let’s explore the key elements that will guide you on this journey.

The mortgage is at the center of home financing fundamentals. It’s a loan tied to the property you want to buy. This agreement sets the terms, interest rates, and how you’ll pay back the loan each month. Knowing about different mortgages, down payments, and credit scores helps you make smart choices.

Your credit score plays a big role in getting a mortgage. Lenders check it to see if you’re a good risk. Keeping your credit score high can lead to better loan terms.

It’s also vital to look at different home financing options. You might consider conventional loans, government-backed programs, or special loans. Each has its own rules and benefits. So, it’s important to do your homework.

Learning about home financing basics will help you feel more confident. Stay updated, ask for advice, and you’ll be closer to owning your dream home.

Types of Home Loans

When you dream of owning a home, knowing about home loans is key. There are two main types: conventional loans and government-insured loans. Each has its own benefits and features.

Conventional Loans

Conventional loans are not backed by the government. They usually need a down payment of 10% to 20% of the home’s price. These loans offer more flexibility in loan amounts and interest rates. They’re great for those with good credit and steady jobs.

Government-Insured Loans

Government-insured loans, like FHA, VA, and USDA, are backed by federal agencies. They have easier credit and down payment rules. These loans help more people buy homes, including first-timers, low-income folks, and military members.

- FHA loans: Insured by the Federal Housing Administration, FHA loans require a minimum down payment of 3.5% and are often more accessible for borrowers with lower credit scores.

- VA loans: Guaranteed by the U.S. Department of Veterans Affairs, VA loans are available to active-duty service members, veterans, and eligible spouses, and typically require no down payment.

- USDA loans: Backed by the U.S. Department of Agriculture, USDA loans are designed to support homeownership in rural and suburban areas, and may require no down payment for eligible borrowers.

| Loan Type | Down Payment Requirement | Credit Score Requirement | Eligible Borrowers |

|---|---|---|---|

| Conventional Loan | 10% – 20% | Good to Excellent | General Public |

| FHA Loan | 3.5% | Minimum 580 | General Public |

| VA Loan | 0% | Minimum 580 | Active-duty Service Members, Veterans, Eligible Spouses |

| USDA Loan | 0% | Minimum 640 | Low-income Borrowers in Rural/Suburban Areas |

Knowing about home loans helps you choose the right one for you. It’s all about finding the best fit for your financial situation and dreams of homeownership.

Determining Your Mortgage Budget

Creating a solid mortgage budget is key when you’re buying a home. It shows how much you can pay each month without breaking the bank. We’ll help you figure out your affordability by looking at your income, debts, and monthly payments.

Calculating Affordability

To start, you need to know your financial health. Think about these things:

- Your monthly income from jobs, bonuses, or freelance work.

- Any debts you have, like credit cards, student loans, or car loans.

- How much you want to spend on your home each month. It should be less than 28% of your income.

With this info, you can use online tools or talk to a lender. They can tell you the highest home price and loan you can handle. This makes it easier to find a home that fits your budget.

| Factors | Example Values |

|---|---|

| Gross Monthly Income | $6,000 |

| Existing Debt Payments | $1,000 |

| Desired Monthly Housing Payment | $1,680 (28% of Gross Income) |

| Estimated Affordable Home Price | $350,000 |

Keep in mind, your mortgage budget and affordability are just the beginning. As you move forward, your lender will give you a detailed review. They’ll make sure you’re okay with your monthly payments.

Improving Your Credit Score

When you start looking for a home loan, your credit score is very important. It affects the interest rates and loan terms you can get. Luckily, there are ways to improve your credit score and get better home loan options.

One great way to boost your score is to check your credit report often and fix any mistakes. Mistakes in your report can hurt your score. So, it’s key to look over your report and fix any wrongs with the credit bureaus.

- Regularly check your credit report from the three major credit bureaus: Equifax, Experian, and TransUnion.

- Identify and dispute any errors or inaccuracies in your credit report, such as incorrect account information or missed payments.

- Ensure that your credit report reflects your positive credit history and on-time payments.

Another important strategy is to lower your credit utilization ratio. This is how much credit you use compared to what you have available. Try to keep this ratio under 30% to show you’re a responsible borrower and improve your score.

- Pay down your outstanding balances, focusing on high-interest credit cards first.

- Request credit limit increases from your credit card issuers to expand your total available credit.

- Avoid opening new credit accounts, which can temporarily lower your credit score.

By using these strategies and keeping an eye on your credit, you can improve your credit score. This will help you get better home loan terms. Remember, a good credit score is a big plus when buying a home. So, focus on improving it as you get ready to buy.

“Maintaining a healthy credit score is essential for navigating the home financing landscape successfully. With the right approach, you can put yourself in a strong position to achieve your homeownership goals.”

Prequalification vs. Preapproval

Starting your home buying journey? It’s key to know the difference between prequalification and preapproval. These terms are often mixed up, but they mean different things for your mortgage chances and home purchase success.

The Importance of Getting Preapproved

Prequalification gives a rough idea of how much you can borrow. But preapproval goes deeper. A lender checks your finances, like your credit score, income, and debts. They then give you a clear loan amount and interest rate you qualify for.

Getting preapproved has big benefits:

- It shows sellers you’re a serious and qualified buyer, making your offer stronger.

- Preapproval letters are more powerful than prequalification, showing a lender’s commitment to finance your home.

- With a preapproval, you beat out other buyers still in the prequalification stage.

Getting preapproved makes the home buying process smoother. It boosts your chances of having your offer accepted, leading to a smoother and more successful deal.

“Preapproval is a crucial step that shows sellers you’re a serious buyer and ready to move forward with a transaction.”

Home Financing: Exploring Your Options

Understanding home financing can seem overwhelming. But knowing the different options helps you make a choice that fits your financial goals. Whether you’re buying your first home or investing in real estate, there are many home financing options to explore.

Conventional mortgages are a common choice. They often require a 20% down payment and have good interest rates. But, if you don’t have a lot saved, government-backed loans like FHA, VA, and USDA might be better. They usually need less money down.

There are also other home financing options to think about. For example, jumbo loans for expensive homes, bridge loans for moving between homes, and even crowdfunding or home equity lines of credit (HELOCs).

| Financing Option | Down Payment | Interest Rates | Eligibility |

|---|---|---|---|

| Conventional Mortgage | 20% or more | Competitive | Good credit, steady income |

| FHA Loan | As low as 3.5% | Moderate | First-time or low-income buyers |

| VA Loan | 0% | Low | Active military or veterans |

| USDA Loan | 0% | Low | Low-income buyers in rural areas |

The right home financing option depends on your financial situation and goals. By looking at your options and talking to a mortgage lender, you can make a smart choice. This is a big step towards owning your own home.

Down Payment Strategies

The down payment is key in buying a home. Knowing how much you need can help you save. We’ll look at ways to save for a down payment and make buying a home easier.

Understanding Down Payment Requirements

The amount you need for a down payment varies by loan type. Conventional loans often ask for 20% of the home’s value. But, FHA, VA, and USDA loans might only need 3.5% to 0%.

| Loan Type | Minimum Down Payment |

|---|---|

| Conventional Loan | 20% of home value |

| FHA Loan | 3.5% of home value |

| VA Loan | 0% of home value |

| USDA Loan | 0% of home value |

Knowing the down payment requirements helps you plan. You can then set up down payment strategies to save enough for your dream home.

Remember, the down payment is a big part of buying a home. So, it’s important to save well. With the right plan, you can make your dream of owning a home come true.

Closing Costs and Other Fees

Buying a home is more than just getting a mortgage. You also need to pay for closing costs and other fees. These can add up fast. It’s important to know about these costs to budget well and have a smooth home-buying experience.

Closing costs include things like loan origination fees and appraisal fees. You’ll also pay for title insurance and other administrative charges. These costs can be 2% to 5% of the home’s price, depending on where you are and your loan details. You might also pay for home inspections, credit reports, and document prep.

Here are some common costs you might face:

- Loan Origination Fee: This fee is 0.5% to 1% of your loan amount. It covers the lender’s work.

- Appraisal Fee: The lender will check the home’s value. This costs $300 to $500.

- Title Insurance: This protects you and the lender from title issues. It costs $800 to $2,000.

- Recording Fees: Local governments charge $100 to $200 to record the deed and mortgage.

While these closing costs and fees might seem high, knowing about them helps you budget. This way, you can avoid surprises during the home-buying process. By understanding these costs early, you can make better decisions and smoothly move into homeownership.

Working with Mortgage Lenders

Finding the right mortgage lender is key when buying a home. You need to look at many mortgage lenders to find the best one for you. Look at things like interest rates, fees, customer service, and reputation to make a good choice.

Choosing the Right Lender

To pick the right lender, start by making a list of good mortgage companies near you. Look for ones with a good reputation, positive reviews, and know the local housing market well. Compare their loans, rates, and fees to find the best deal.

When looking at mortgage lenders, consider these:

- Interest rates and annual percentage rates (APRs)

- Origination fees and other costs

- How good their customer service is

- The variety of loans they offer

- How well they know the local housing market

- How easy their application and approval process is

By looking at these things, you can pick a mortgage lender that will help you get the best financing.

“Finding the right mortgage lender can make all the difference in the home buying process. Take the time to research and compare your options to ensure you get the best deal.”

| Lender | Interest Rate | Fees | Loan Programs | Customer Satisfaction |

|---|---|---|---|---|

| Acme Mortgage | 4.75% | $1,500 | Conventional, FHA, VA | 4.8/5 |

| XYZ Financial | 4.90% | $1,800 | Conventional, FHA | 4.6/5 |

| Hometown Lending | 4.85% | $1,650 | Conventional, VA, USDA | 4.7/5 |

Homeowners Insurance Essentials

Homeowners insurance is key when you buy a home. It protects your home and stuff from unexpected damage. Let’s explore how it keeps your investment safe.

Understanding Homeowners Insurance Coverage

Homeowners insurance covers many risks, like:

- Damage to your home’s structure, such as from fires, storms, or vandalism

- Replacement or repair of your personal belongings, like furniture, electronics, and clothing

- Liability protection in case someone is injured on your property and decides to sue

- Additional living expenses if your home becomes uninhabitable due to a covered event

The details of your coverage depend on your policy. Always check with your insurance provider.

Importance of Homeowners Insurance

Homeowners insurance is not just a luxury; it’s a must-have. Most lenders need you to have it before they approve your loan. It offers financial stability and peace of mind, covering the costs of repairs or replacements in case of disaster.

Choosing the Right Homeowners Insurance Policy

When picking a policy, consider these factors:

- Coverage limits: Make sure the policy covers your home and belongings well.

- Deductibles: Choose a deductible that fits your budget and risk level.

- Discounts: Look for discounts for things like home security systems or bundling policies.

- Reputation and customer service: Research the provider’s ratings and claims process for reliability and responsiveness.

Knowing the basics of homeowners insurance helps you make a smart choice. It protects your biggest investment – your new home.

| Coverage Type | Description | Typical Limits |

|---|---|---|

| Dwelling Coverage | Covers damage to the structure of your home | Typically 80-100% of your home’s replacement cost |

| Personal Property Coverage | Covers the replacement of your personal belongings | Typically 50-70% of your dwelling coverage |

| Liability Coverage | Covers legal expenses if someone is injured on your property | Typically $100,000 to $500,000 |

| Additional Living Expenses | Covers the cost of temporary housing if your home is uninhabitable | Typically 20% of your dwelling coverage |

Knowing about different coverages and their limits helps you choose the right policy. It ensures you get the protection you need.

Conclusion

As we wrap up our guide on home financing, let’s recall the main points. We’ve learned about the home buying process, home loans, and how to get ready financially. Now, you’re ready to take on the journey to homeownership.

We’ve covered various home loans, how to plan your mortgage budget, and boosting your credit score. You also know how to choose reliable mortgage lenders. This knowledge helps you make smart choices that fit your financial plans. Remember, the home financing journey might seem tough, but it’s manageable step by step.

Now, it’s time to move forward towards your dream home. Keep researching, ask for advice from experts, and stay focused on your goal. With dedication, you’ll soon enjoy the rewards of homeownership. The journey has its hurdles, but the pride and joy of owning a home are worth it.