Personal finance is key to our lives, but it can feel hard to handle. As someone who loves personal finance, I want to share smart ways to manage your money. This guide will help you with budgeting, saving, and investing. You’ll get the tools to improve your financial health.

Key Takeaways

- Learn essential personal finance fundamentals to make informed decisions.

- Develop a practical budgeting system to track your expenses and increase savings.

- Explore effective investment strategies to grow your wealth over the long term.

- Manage your debt wisely and prioritize high-interest obligations.

- Protect your assets with appropriate insurance coverage.

Understanding Personal Finance Fundamentals

Personal finance is about managing your money. This includes budgeting, saving, investing, and protecting your assets. Knowing the basics of personal finance helps you make smart choices. It also helps you reach your financial goals and secure your future.

What Is Personal Finance?

Personal finance covers managing your money in different ways. It’s about earning, spending, saving, and investing. By creating a budget and tracking your expenses, you can set financial goals. This way, you can take charge of your financial future and aim for a better life.

Why Personal Finance Matters

Managing your finances well is very important for several reasons:

- It helps you reach your financial goals, like saving for a house or retirement.

- It lets you make smart money choices, avoiding costly mistakes.

- It helps you pay off debt, build wealth, and gain financial freedom.

- It gives you peace of mind and financial security, letting you enjoy life more.

Learning about personal finance is the first step to controlling your financial future. By understanding the basics, you’ll be ready to handle the complex world of personal finance. This way, you can make the best choices for your financial health.

“Wealth is the ability to fully experience life.” – Henry David Thoreau

Budgeting: The Key to Financial Success

Creating a personal finance plan begins with budgeting. By making a detailed budget and tracking your money, you can control your spending. This ensures your funds go towards important goals, like saving for a home or paying off debt.

Budgeting is the base of good personal finance management. It helps you:

- Find ways to save money and spend smarter

- See how your money moves each month, helping you make better choices

- Match your spending with your big financial dreams

- Become more aware and disciplined with your finances

Creating a budget doesn’t have to be hard. Many easy-to-use budgeting apps and tools can help. By spending a few minutes each week on your budget, you’ll move closer to financial stability and success.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Budgeting might take some work at first, but the benefits are huge. With a good budget, you can manage your personal finance and open doors to financial freedom and success.

Strategies for Effective Saving

Building a solid financial foundation starts with a consistent savings habit. We’ll explore strategies to automate your savings and set realistic goals. These will help you achieve your personal finance and home-related objectives.

Automating Your Savings

One effective way to save money is to make it automatic. Set up recurring transfers from your checking to a savings account. This way, a part of your income is always saved, making it harder to spend it.

This “set it and forget it” method helps your savings grow steadily. You won’t have to remember to transfer funds each month.

Setting Realistic Goals

Clear, achievable savings goals are key to staying motivated. Whether saving for a home down payment, an emergency fund, or retirement, set specific targets. Create a plan to reach them.

Break down big financial goals into smaller steps. This makes progress easier and lets you celebrate your successes.

| Savings Goal | Target Amount | Timeline |

|---|---|---|

| Emergency Fund | $10,000 | 18 months |

| Down Payment on a Home | $50,000 | 5 years |

| Retirement Savings | $500,000 | 25 years |

Remember, personal finance is a journey, not a destination. By using these strategies and regularly checking your progress, you can control your financial future. You’ll reach your home and personal finance goals.

“The key is not to prioritize what’s on your schedule, but to schedule your priorities.” – Stephen R. Covey

Investing for the Long Term

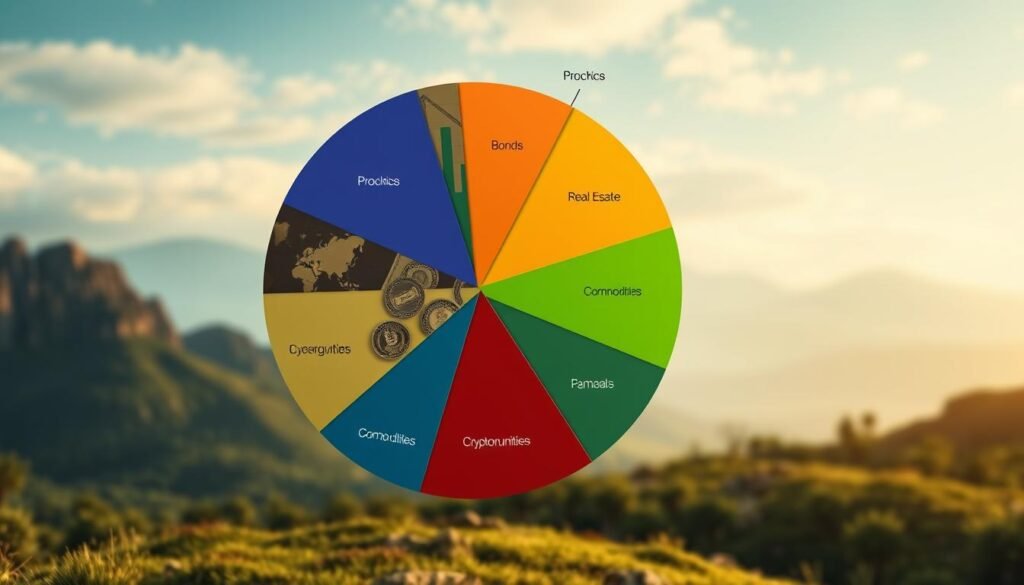

Investing your money wisely is key to personal finance. It helps you build wealth and reach your financial goals. A good strategy is to diversify your portfolio. This means spreading your investments across different types to manage risk and increase potential returns.

Diversifying Your Portfolio

Diversifying your portfolio is a basic rule of investing. By investing in various assets like stocks, bonds, real estate, and alternatives, you lower your risk. This protects your personal finance and home investments from market ups and downs.

- Stocks offer growth and high returns but come with more risk.

- Bonds provide stability and income but have lower returns than stocks.

- Real estate investments can give steady income and potential for growth.

- Alternative investments, like commodities or cryptocurrencies, offer diversification and high returns but also high risk.

By mixing these assets, you create a balanced portfolio. This portfolio is more stable against market changes and better prepared for economic downturns. Regularly rebalancing keeps your portfolio aligned with your long-term financial goals.

| Asset Class | Risk Level | Potential Returns |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Moderate |

| Real Estate | Moderate | Moderate-High |

| Alternatives | High | High |

By diversifying your personal finance and home investments, you build a balanced portfolio. This portfolio helps you navigate market changes and work towards your long-term financial goals.

Managing Debt Wisely

Debt can weigh heavily on your finances, but smart strategies can help. Focus on high-interest debt, like credit card balances. This approach can make paying off your debt more efficient.

Prioritizing High-Interest Debt

Managing debt means tackling high-interest first. High-interest debt, like credit card balances, grows fast. By focusing on these, you save on interest and pay off debt quicker.

Here are ways to tackle high-interest debt:

- Create a debt management plan: Look at your debt, including interest rates and balances. Plan to pay off the highest-interest debts first.

- Utilize balance transfer offers: Find credit cards with lower interest rates. This can save you money and help pay down the principal faster.

- Explore debt consolidation loans: Combine multiple high-interest debts into one, lower-interest loan. This simplifies payments and may lower the total interest paid.

- Negotiate with creditors: Talk to your creditors about lower interest rates or better repayment plans. Many are willing to help manage your debt.

By focusing on high-interest debt and using smart strategies, you can take back control of your finances. This will help you on your path to becoming debt-free.

Protecting Your Assets with Insurance

Insurance is key in personal finance. It keeps your money safe from surprises. Health, life, and home insurance are all important for your financial safety.

Health insurance helps with medical bills. It covers everything from check-ups to big surgeries. Life insurance supports your family if you pass away too soon.

Home insurance guards your biggest asset. It protects against disasters, theft, and more. This insurance means you won’t face huge repair costs alone.

It’s vital to know about insurance types and their benefits. Choosing the right policies builds a strong financial base. This protects you and your family for years to come.

“Insurance is not just a financial product – it’s a way to protect your financial future and the well-being of your family.” – Jane Doe, financial expert

Types of Insurance to Consider

- Health insurance: Covers medical expenses and helps you maintain your overall well-being.

- Life insurance: Provides financial security for your loved ones in the event of your passing.

- Home insurance: Protects your home and personal property from various risks, such as natural disasters and theft.

- Auto insurance: Covers the cost of damages or injuries resulting from car accidents.

- Disability insurance: Replaces a portion of your income if you become unable to work due to a disability.

Understanding insurance’s role in personal finance is crucial. By picking the right policies, you secure your financial future and protect your assets.

Retirement Planning: Securing Your Future

Planning for retirement is key to your financial future. Knowing about different retirement accounts helps you make smart choices. This ensures a comfortable life after work.

Understanding Retirement Accounts

Accounts like 401(k)s and IRAs help you save for retirement. They offer tax benefits. Learning about these can help you plan well for your future.

401(k)s let you save a part of your paycheck before or after taxes. Many employers match your contributions. IRAs give you more freedom in choosing investments and can be used even without a workplace plan.

| Retirement Account | Key Features | Tax Considerations |

|---|---|---|

| 401(k) |

|

|

| Traditional IRA |

|

|

| Roth IRA |

|

|

Understanding retirement accounts helps you save more and pay less in taxes. This way, you can secure a financially stable retirement.

Personal Finance: A Comprehensive Approach

Personal finance isn’t just about budgeting or investing. It’s about combining all financial aspects for long-term success. This approach helps you make better financial decisions and reach your goals.

Every person’s financial situation is different. Your unique needs and goals guide your financial strategies. This way, you can create a plan that fits your life perfectly.

Budgeting is key, but it’s not the only thing. You also need to think about debt, investments, and insurance. A holistic view ensures all your financial activities support your overall well-being.

Investing for the future is important, but it’s part of a bigger picture. Your investment plan should match your risk level, time frame, and other financial goals. This way, you can balance your priorities and create a unified plan.

Life events like job changes or marriage affect your finances. A comprehensive approach helps you adapt your financial plan. This way, you can stay on track, even when things change.

Personal finance is more than just parts. It’s about understanding your financial situation and integrating all aspects for stability and growth. By taking a comprehensive approach, you can manage your finances effectively and achieve long-term success.

Building an Emergency Fund

An emergency fund is key in personal finance. It helps you face unexpected money problems. This could be a medical issue, losing your job, or a big home repair.

Having enough money set aside can help you stay financially stable. It acts as a safety net during tough times.

Determining Your Emergency Fund Needs

The right amount for your emergency fund depends on your situation. This includes your income, expenses, and lifestyle. A common advice is to save enough for three to six months of living costs.

This amount helps you deal with sudden money issues. You won’t have to use your long-term savings or get into debt.

To figure out how much you need, track your monthly essential expenses. This includes rent, utilities, groceries, and more. Then, multiply this by three to six to find your target.

Building an emergency fund is a process. Start with a small amount and add more as you can. Setting up automatic transfers makes saving easier and faster.

“An emergency fund is the foundation of a solid personal finance plan. It provides a safety net during unexpected life events and helps you avoid dipping into long-term savings or taking on debt.”

Creating and keeping an emergency fund is a big step towards financial security. It helps you feel more confident and secure, even when life gets unpredictable.

Maximizing Tax Efficiency

As a savvy personal finance enthusiast, I know that optimizing your tax strategy is crucial for boosting your financial well-being. In this section, we’ll explore various ways to minimize your tax burden. We’ll make sure you’re making the most of your home and investment assets.

One of the most effective strategies is to take advantage of tax-advantaged investment accounts. These include 401(k)s, IRAs, and Health Savings Accounts (HSAs). These accounts allow your money to grow tax-deferred or even tax-free. This provides a significant boost to your long-term savings.

Another key consideration is leveraging available deductions and credits. From mortgage interest and property taxes to charitable contributions and medical expenses, there are many deductions. These can help reduce your taxable income and lower your overall tax liability.

- Maximize contributions to tax-advantaged retirement accounts

- Claim eligible deductions and credits on your tax return

- Explore strategies for minimizing capital gains taxes on investment income

- Stay up-to-date with changes in tax laws and regulations that may impact your personal finance situation

By staying informed and proactive about tax planning, you can ensure that your home and investment assets are working as hard as possible for you. This will ultimately boost your overall financial well-being.

“The only difference between a tax man and a taxidermist is that the taxidermist leaves the skin.” – Mark Twain

Estate Planning: Protecting Your Legacy

As a responsible personal finance enthusiast, it’s crucial to consider the importance of estate planning. This often-overlooked aspect of managing your finances ensures your assets and wishes are properly handled after you’re gone. Estate planning involves creating a comprehensive plan that outlines how your belongings, property, and investments will be distributed, as well as how any outstanding debts or taxes will be addressed.

At the heart of estate planning lies the creation of a will, which serves as a legally binding document that specifies your beneficiaries and how your assets should be distributed. Additionally, establishing a trust can help streamline the transfer of your wealth and protect your loved ones from potential complications. Power of attorney, another essential component, grants someone you trust the authority to make important decisions on your behalf should you become incapacitated.

By taking the time to thoughtfully plan your estate, you can provide peace of mind for your family and ensure your legacy is protected. Whether you own a home or have accumulated various personal finance assets over the years, estate planning is a valuable investment in your family’s future.

“Estate planning is not just about what happens when you die. It’s about making sure your wishes are carried out and your loved ones are taken care of, no matter what happens in life.”

Remember, estate planning is not a one-size-fits-all solution. It’s essential to work closely with a qualified legal professional who can help you navigate the nuances and ensure your plan aligns with your unique circumstances and goals.

By prioritizing estate planning, you can take proactive steps to protect your legacy and provide for your loved ones, even after you’re gone. It’s a critical component of a comprehensive personal finance strategy that shouldn’t be overlooked.

Achieving Financial Independence

Many people dream of financial independence. It means having the freedom to live life as you want, without worrying about money. We’ll look at ways to get there, like building passive income and improving your personal finance.

Passive Income Streams

Passive income is key to financial freedom. It’s money that comes in without you working for it every day. This can be from renting out properties, investing in stocks, or running an online business. By having different income sources, you can lessen your need for a regular job.

- Rental properties: Investing in real estate can provide a steady stream of rental income, with the potential for long-term appreciation in the home value.

- Dividend-paying stocks: Building a portfolio of stocks that pay regular dividends can generate passive income without requiring active management.

- Online business ventures: Leveraging your skills and expertise to create an online business, such as a blog, e-commerce store, or digital products, can provide passive income opportunities.

Finding the right passive income streams is important. They should match your interests, skills, and how much risk you’re willing to take. This way, you can build a strong and lasting financial future.

| Passive Income Stream | Potential Advantages | Potential Drawbacks |

|---|---|---|

| Rental Properties | Steady cash flow, potential for appreciation, tax benefits | Upfront investment, maintenance costs, tenant management |

| Dividend-Paying Stocks | Recurring income, potential for capital growth, diversification | Market volatility, research and selection required |

| Online Business Ventures | Scalable, flexible, low overhead | Requires time and effort to build, competition, technological challenges |

By using passive income, you can move closer to financial freedom. This will help you build a better future for yourself.

Navigating Major Life Events

Our financial needs change a lot during big life events. Getting married, starting a family, or changing careers can greatly affect our money. We’ll look at ways to keep your finances strong during these times.

Marriage and Merging Finances

Getting married is exciting but also needs careful money planning. It’s important to talk openly about your money goals, debts, and spending. Creating a shared budget and saving together can help you face financial challenges as a couple.

Welcoming a New Addition

Having a child is a wonderful moment but brings new money worries. You’ll need to budget for childcare, healthcare, and your child’s education. Reviewing your insurance, estate plan, and looking into tax-advantaged savings can help secure your family’s financial future.

Career Transitions

Starting a new career or losing a job can affect your finances. Smart budgeting, managing debt, and a good job search plan can help. This way, you can stay financially stable and set yourself up for success.

Handling big life events well means being flexible and proactive with your money. By planning ahead, you can keep your financial plan up to date. This helps you achieve more financial security and stability.

“The secret to financial freedom is to live life on your own terms, not by the terms dictated to you.” – Robert Kiyosaki

Seeking Professional Guidance

Managing your personal finances is key, but sometimes you might need a pro’s help. We’ll look at when it’s smart to get advice from a financial advisor. They can help you reach your financial goals.

When to Consult a Financial Advisor

Handling personal finance can be tough. There are times when a financial advisor’s expertise is really helpful. Here are some situations where getting professional advice is a good idea:

- Creating a financial plan: A financial advisor can craft a plan that fits your goals and current situation.

- Going through big life changes: They can guide you through retirement planning, managing an inheritance, or divorce.

- Improving your investment strategy: Advisors can help diversify your portfolio and increase your returns.

- Lowering your taxes: They know tax laws well and can find ways to reduce your tax bill.

- Dealing with complex financial decisions: Advisors offer insights on estate planning and managing complex financial products.

Working with a financial advisor can give you the knowledge and support you need. They help you navigate the world of personal finance and make smart choices for your future.

| Situation | Benefit of Consulting a Financial Advisor |

|---|---|

| Developing a comprehensive financial plan | Helps create a personalized plan aligned with your long-term goals, considering your financial situation and preferences. |

| Transitioning through major life events | Provides guidance and support to ensure your financial well-being during pivotal moments, such as retirement or divorce. |

| Optimizing investment strategies | Assists in diversifying your portfolio, minimizing risk, and maximizing investment returns based on your needs. |

| Minimizing tax liabilities | Leverages expertise in tax laws to explore tax-efficient strategies and reduce your overall tax burden. |

| Navigating complex financial decisions | Provides valuable insights and recommendations to help you make informed decisions on estate planning, complex financial products, and more. |

By partnering with a financial advisor, you can gain the expertise and guidance needed to navigate the ever-changing landscape of personal finance and make informed decisions that align with your long-term financial objectives.

Developing Healthy Financial Habits

Building good financial habits is key to long-term success. In the world of personal finance, it’s vital to have a good relationship with money. We need strategies that help us financially.

Mindful spending is a crucial habit. It means thinking about our purchases and making sure they match our values and goals. This helps us avoid buying things on impulse. Learning about personal finance, like budgeting and investing, also helps us make better choices.

It’s important to have a savings mindset. Saving, even a little, helps us build a strong financial base. It prepares us for the unexpected and for our future goals. Setting up automatic savings makes it easier to stick to our plans.

- Practice mindful spending

- Continuously learn about personal finance

- Cultivate a savings-oriented mindset

- Automate your savings

Creating and keeping these habits takes effort and dedication. But the benefits are huge. By having a good relationship with money and using smart strategies, we can secure a brighter future.

“The key to building wealth is the daily habits and disciplines that you create.”

– Thomas J. Stanley

| Habit | Description | Benefits |

|---|---|---|

| Mindful Spending | Carefully considering purchases and aligning them with values and goals | Avoids impulse buys, promotes financial stability |

| Continuous Learning | Staying informed about personal finance topics | Empowers wiser financial decisions, adapts to changing landscapes |

| Savings-Oriented Mindset | Prioritizing savings, even in small increments | Builds a solid financial foundation, prepares for unexpected events |

| Automated Savings | Setting up automatic transfers to savings accounts | Makes the savings process effortless and consistent |

Conclusion

In this guide, we’ve covered the basics of personal finance. You now know how to manage your money better. This includes budgeting, saving, managing debt, and investing for the future.

We’ve also talked about the importance of good financial habits. These include automating savings, setting achievable goals, and getting help when needed. These habits will help you deal with financial challenges and make the most of opportunities.

Personal finance is a journey, not a one-time task. With the right approach, you can always get better at managing your money. By following the advice in this guide, you’re on your way to financial freedom. Start your journey to a better financial future today.